Sending money in time to your home feels like spending a lot when you both are living in different places and different timelines. Taxes, and hidden charges, add to that government fees hunches on the back like a burden. In emergencies, you then do have to wait for long working hours to fill in the paper to send some amount of money to your family, friends, or even guardian.

Well, then this is when you will ask yourself a suggestion- I do need a better option to do this job for me effortlessly. You might as well ask yourself a question then, what provider should I be searching for? When your budget is tight, you require a cheap way to convert GBP to INR and send it to your home country.

Is there a way I can send money from the UK to India?

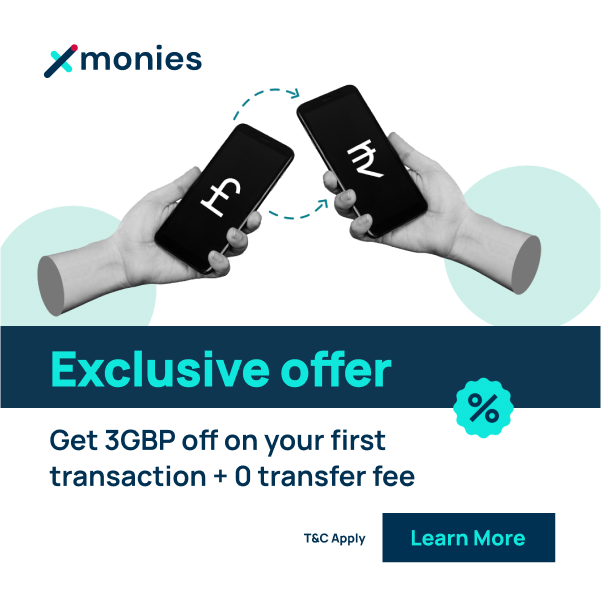

Many of the migrant workers, as well as the NRIs who have been living abroad, would stay put for work while providing for their parents living in India. However, the majority concern for them would be finding a reliable option where the exchange rate does justice to the pockets of millions of workers. Then, Xmonies is what you should look for.

The good thing about making your payment through Xmonies is it comes in handy, easy, and reliable. Nevertheless, you will be able to see that it makes your either way of payment (every day or urgent) within a business day. No biggie in exchange rates comparison or paying hefty hidden costs. It will give you a fair current market value for the exchange rate and an easy comparison.

When you make a comparison between two different options to send money from UK to India to make you commodious, which perfectly ends up being your best match of the transfer method. For example, traditional banks with all wire transfers can be way more expensive, and slow, while many other ones might not offer the best fees, FX rates, and the time of transfer.

Why should you Choose Xmonies for Remittance?

These are some of the most dream-come-true advantages you can obtain when you pick your trust in Xmonies for finance.

- Best Transfer Service.

- A big transfer can be made.

- No hidden charges are applied to transfer.

In today’s globalized world, sending and receiving money has become a frequent necessity for many people. The need for a reliable and efficient money transfer service is paramount for migrants, expats, and NRIs. Among the many companies that provide such services, Xmonies stands out for its excellence in the field. In this article, we will discuss why it is the best and cheapest way of transferring money from the UK to India.

Best Transfer Service

Xmonies provides its customers with an unparalleled level of service, making it the best money transfer service provider in the market. With a user-friendly platform, you can easily send money online from the comfort of your home. The transfer process is straightforward and hassle-free, making it easy for even the most novice users. Moreover, Xmonies has an excellent customer support team that is available 24/7 to help you with any queries or issues you may face.

A Big Transfer Can Be Made

Another advantage of using Xmonies is that they allow big transfers to be made on online transfer. With a high transfer limit of 100000 GBP, you can easily send large amounts of money without having to worry about any restrictions. This feature makes Xmonies the perfect choice for businesses and individuals who need to transfer significant amounts of money frequently.

No hidden charges are applied to transfer

Xmonies is committed to transparency, and this is reflected in its pricing policy. It is the cheapest way to transfer money from UK to India online. They have a no-hidden-cost policy, ensuring that you know exactly how much you are paying for your transfer. Unlike other remittance service providers who often levy hidden charges, making it an affordable option for anyone looking to send money.

Compared with other remittance service providers, one can notice that Xmonies provides its users with a much more reliable, cost-effective, and efficient service than its competitors. Xmonies is superior because of its competitive exchange rates, user-friendly platform, 24/7 customer support, and transparency in pricing.

Best Platforms to Send Money from UK to India Online

Using an online remittance service provider is often the cheapest option for sending money from the UK to India out of all the traditional means. This is because online remittance service providers offer competitive exchange rates and low fees compared to traditional banks or other money transfer options. These services use digital platforms to facilitate transactions, which eliminates the need for expensive physical infrastructure and reduces overhead costs.

Online remittance service providers also offer the convenience of being able to send money from the comfort of your home, without having to physically visit a bank or a money transfer location.

Furthermore, many online remittance service providers offer fast transfer times, with some transfers being completed within a few hours. This makes them a popular choice for sending money to India from the UK. With the growing popularity of online remittance service providers, it is now easier than ever to send money from UK to India quickly, securely, and at a low cost.

- Xmonies

Xmonies is one of the cheapest options to transfer money from the UK to India in 2023. They offer fair current market value on exchange rates and a transparent process with no hidden charges. Their transfer speed is fast, with most transactions being completed within a business day. Xmonies is also regulated by the Financial Conduct Authority (FCA), ensuring that your transactions are safe and secure. With excellent customer support and a user-friendly platform, Xmonies is a reliable and convenient choice for sending money to India.

- TransferWise

TransferWise is another popular option for sending money from UK to India. They offer a mid-market exchange rate, which means that you get a fair and transparent rate for your money. TransferWise charges a small, upfront fee for transfers, which is often lower than those charged by banks or other remittance services. They also offer fast transfer times, with most transactions being completed within a few hours. TransferWise is regulated by the FCA, ensuring that your transactions are safe and secure.

- Azimo

Azimo is a popular remittance service provider that offers competitive exchange rates and low fees for sending money to India. They offer a fast and efficient transfer service, with most transactions being completed within a few hours. Azimo is also regulated by the FCA, ensuring that your transactions are safe and secure.

- WorldRemit

WorldRemit is another option for sending money from the UK to India online. They offer competitive exchange rates and low fees for transfers, making it a cost-effective option to transfer money to India. WorldRemit offers a fast and efficient transfer service, with most transactions being completed within days.

Compared to traditional banks and other money transfer options, online remittance service providers offer competitive rates and low fees. They also provide the convenience of being able to send money from the comfort of your home and fast transfer times. With the growing popularity of these providers, sending money from the UK to India has never been easier or more affordable.

In conclusion, sending money from the UK to India can be a challenge, especially for those on a tight budget. However, online remittance service providers like Xmonies have made the process easier and more affordable. As it offers fair exchange rates, transparent pricing, and fast transfer times, making it a popular choice for migrants, expats, and NRIs who need to send money to India.

When it comes to money transfer from the UK to India, Xmonies stands out as the top choice for those seeking the most affordable and efficient service.