In a world where connections bridge geographical distances, the ties between countries like Sri Lanka and the United Kingdom have thrived over the years. Families separated by miles, students pursuing education abroad, and businesses expanding their branches – all have their stories interwoven between these two nations.

Amidst these global connections, the need to understand the currency exchange rates becomes more important. Our “GBP to LKR Conversion – A Comprehensive Guide” holds vital insights that can shape your financial decisions to maximize value of your money.

Great British Pound (GBP) And Sri Lankan Rupee (LKR):

The great British Pound is symbolized as £ and is further divided into units of 100s known as pence. It ranks fourth in the list of most traded currency globally, as it followed by USA dollar, the euro, and the Japanese yen in terms of being popularity in the exchange market.

Its history dates back to the 7th century, as the origin of the pound is tied to a silver coin’s weight, also known as pound weight. In the 13th century, its definition shifted to represent a fixed weight of gold.

Term the pound sterling, it operates as a floating currency, its value is shaped by supply and demand in the foreign exchange market. Numerous factors impact its worth, including economic growth, interest rates, and political stability.

Sri Lankan Rupee

LKR which is the Sri Lankan Rupee is issued by the Central Bank of Sri Lanka as it serves to be an official currency of the nation. It’s divided into 100 cents, though cents are scarcely used due to their low value. The common abbreviations for the currency are Re (singular) and Rs (plural), while the World Bank suggests using SL Rs to distinguish it from other rupee-named currencies. The exchange rate of the country as of August 22, 2023, stands at 1 USD= 203 LKR.

Pound has become strong due to :

Post-Pandemic Recovery: The UK economy’s rebound from the impacts of COVID-19 has bolstered the pound’s value.

Interest rate Increase: The decision to increase the interest rate by the Bank of England has been proven to contribute to the rise of the pound.

Safe Haven Status: The UK’s reputation as a haven currency during times of global uncertainty has further elevated the GBP’s standing.

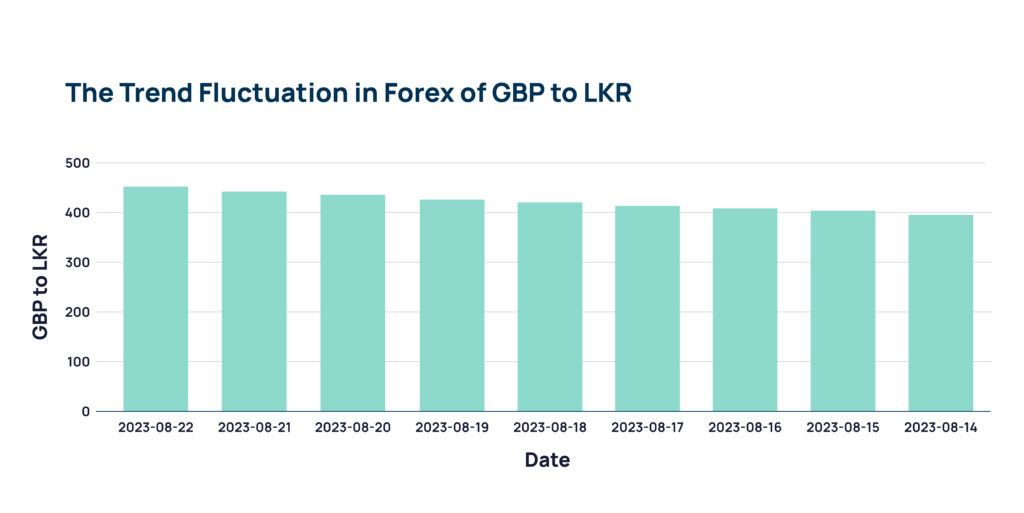

Trend Fluctuation of GBP to LKR for August 2023:

The GBP to LKR exchange rate has shown noticeable fluctuations in recent months. On its peak day, which was August 17, 2023, 1 GBP was equivalent to 404.217 LKR. Conversely, the lowest point was observed on August 14, 2023, with 1 GBP valued at 399.462 LKR.

Factors affecting the exchange rate from GBP to LKR

- Interest Rates and Economic Growth

The difference in interest rates between UK and Sri Lanka plays an important role. The UK’s higher interest rates can attract more foreign investments, which, in turn, increases demand for GBP and causes it to appreciate against the LKR.

Also the economic growth rate of both countries plays an important role as investors tend to favor a strong and robust economy (here UK), eventually impacting their exchange rates. - Political Stability

Investors will gain confidence if there is political stability in the countries. Political turmoil in Sri Lanka can discourage foreign investment, leading to the depreciation of the LKR against the GBP. - Trade Balance

The Forex rate or foreign exchange rate can be affected by the volume and the balance of trade between both the countries. If UK imports more goods and services from SRI Lanka as compared to its exports to SRI Lanka, then there is high speculation or likely a chance of the LKR to appreciate against the GBP. - Speculation

When we say speculation, it clearly means anticipation of strength of both the currencies i.e., LKR and GBP. However, the speculative activities and the sentiments of investors can actually affect the exchange rates. If Investors, in general, anticipate GBP strengthening against the LKR, they may buy more or increase their demand for GBP which will lead to its appreciation.

It’s important to note that the foreign exchange rates are in a constant state of fluctuation, making it challenging to predict their exact changes. However, understanding these small yet crucial factors can help an individual as well as business to make more informed decisions regarding their currency exchange.

Tips to convert GBP to LKR effortlessly:

- Compare Exchange Rates: Before exchanging your money, compare exchange rates of multiple websites offering money transfer services, to get the best rate. A website like Xmonies can help you compare these rates in minutes. This step is crucial because it helps save you both money and time.

- Watch Out for Hidden Fees: Some online service providers might sneak in extra charges, like adding a slight markup on the exchange rate. To avoid this, carefully read the terms and conditions mentioned on their websites to make sure you’re not paying any hidden fees.

- Consider a Money Transfer Guarantee: Look out for those service providers that offer “rate lock guarantees”. This can be helpful if you’re worried about rate fluctuations and wish to secure the initial exchange rate you see when you started the process.

- Use a Secure Website: When you send money online, always Prioritize a secure website. Look for a service that uses encryption to protect your personal and financial information. This ensures that your data is safe while making the transfer.

Conclusion:

The GBP to LKR exchange rate is affected by multiple factors including interest rates, economic growth, political stability, trade, and speculation.

Predicting its changes is complex due to constant fluctuations. Understanding these influences is essential for informed currency exchange decisions.

Also, LKR depreciation, caused by trade imbalances, reduced reserves, and political uncertainty, brings negative consequences like inflation and reduced purchasing power.

Recent months shows notable GBP to LKR rate shifts, emphasizing the need to grasp these dynamics for better decision-making.